If the Traveler chooses to pay with hisher credit card the earliest reimbursement is via the. While there is no Limit on expense categories there are types of expenses that are not business or are not reportable and this depends on your business operations your entity type and the local regulations that apply.

Whether the LdCITA has erred on facts and in law in deleting the disallowance of revenue expenses us 371 of the Act claimed in return of income of Rs.

. Expenditure Cap on Qualifying Costs. Prior to YA 2013 the cap was 150000 for every relevant three-year period. UNDER SECTION 33 ITA 1967.

Specific prohibitions under subsection 391 of the ITA. 40A 3 If Income computed by applying gross profit rate. Only expenditures not specified under Sections 30 to 36 and expended entirely for the company is permitted as a deduction when calculating taxable business profits under Section 371 of the Income-tax Act of 1961.

Paragraph 331c of the ITA allows a deduction for the expenses wholly and exclusively incurred for. The amount of the unused credit which may be taken into account under section 38a1 for any succeeding taxable year shall not exceed the amount by which the limitation imposed by section 38c for such taxable year exceeds the sum of the amounts which by reason of this section are carried to such taxable year and are attributable to taxable years preceding the unused credit. Allowable and Unallowable Costs.

7 To be allowable under section 331 expenses must fulfill all the following. UH Purchasing Card Purchase Order or via the Travelers personal credit card. Professional expenses are subsections 331 and 391 of the Income Tax Act 1967 ITA.

31 Person includes a company a co-operative society a club an association a Hindu joint family a trust and estate under administration a partnership and an individual. Understanding Allowability of Business Expenditure under section 37 of the Income Tax Act 1961 with latest case laws. The question to be decided is whether the expenditure was an outgoing or expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source in section 33 as qualified within set limits by section 39.

31 The brief facts of this issue is that the assessee showed amounts payable to Ms. 3990797 in the facts and circumstances of the case. Capital allowances and deductions.

Additional medical expenses tax credit 31 Disability Under section 6B3b of the Act a taxpayer who has or whose spouse or childhas a disability as defined that is in accordance with criteria prescribed by the Commissioner for SARS in the ITR -DD form will be able to claim qualifying medical expenses inclusive of VAT. Cash gifts presents against section 40A 3 provisions not allowable. A submit all the records or documents that meet the requirements specified in the notice issued under section 81 of the ITA or b furnish the required information within the timeframe stipulated in the.

In the case of CIT v. Effective YA 2013 the amount of RR costs that qualify for tax deduction as a business expense is capped at 300000 for every relevant three-year period starting from the year in which the RR costs are incurred. Disallowable expenses for corporation tax Blog.

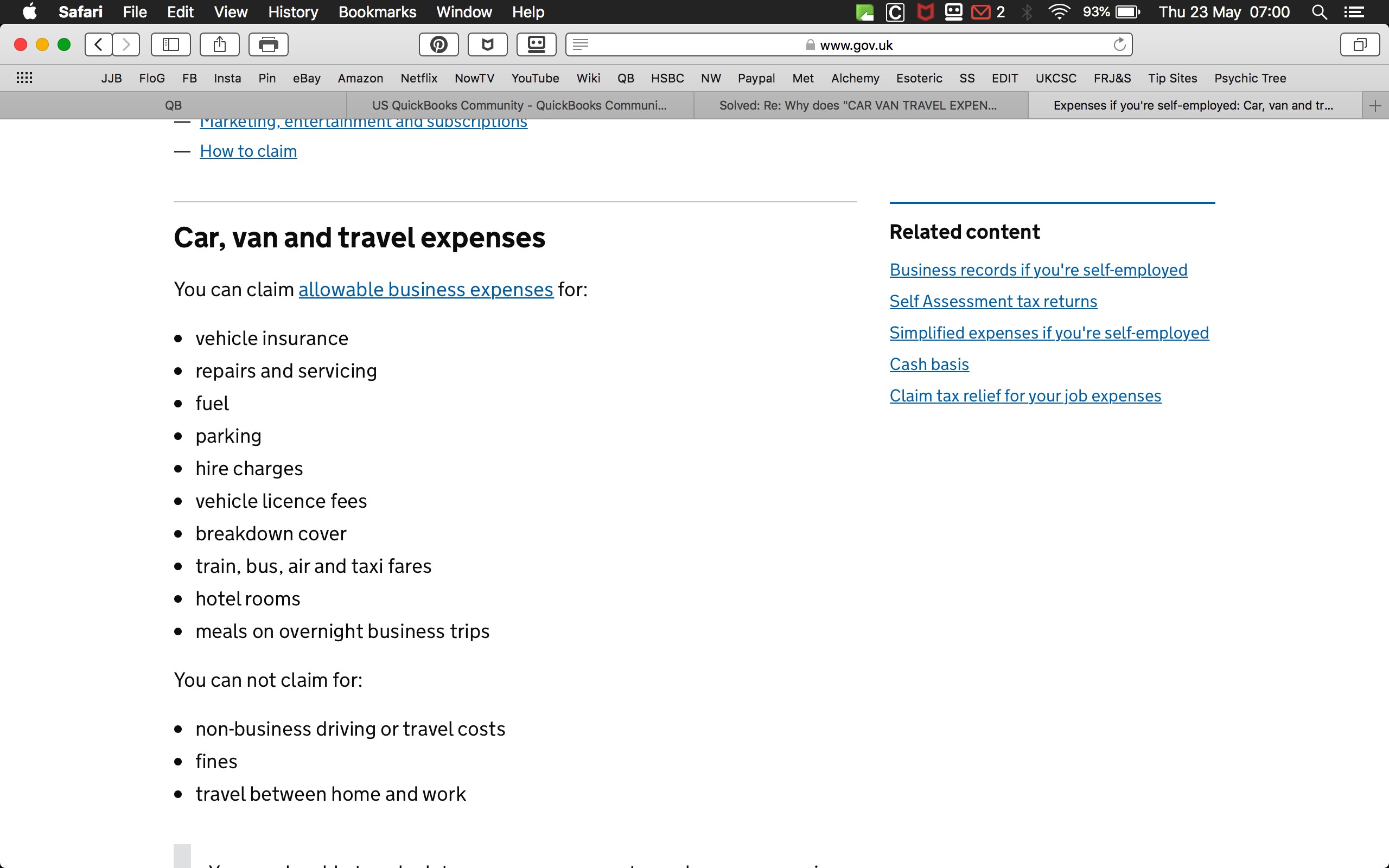

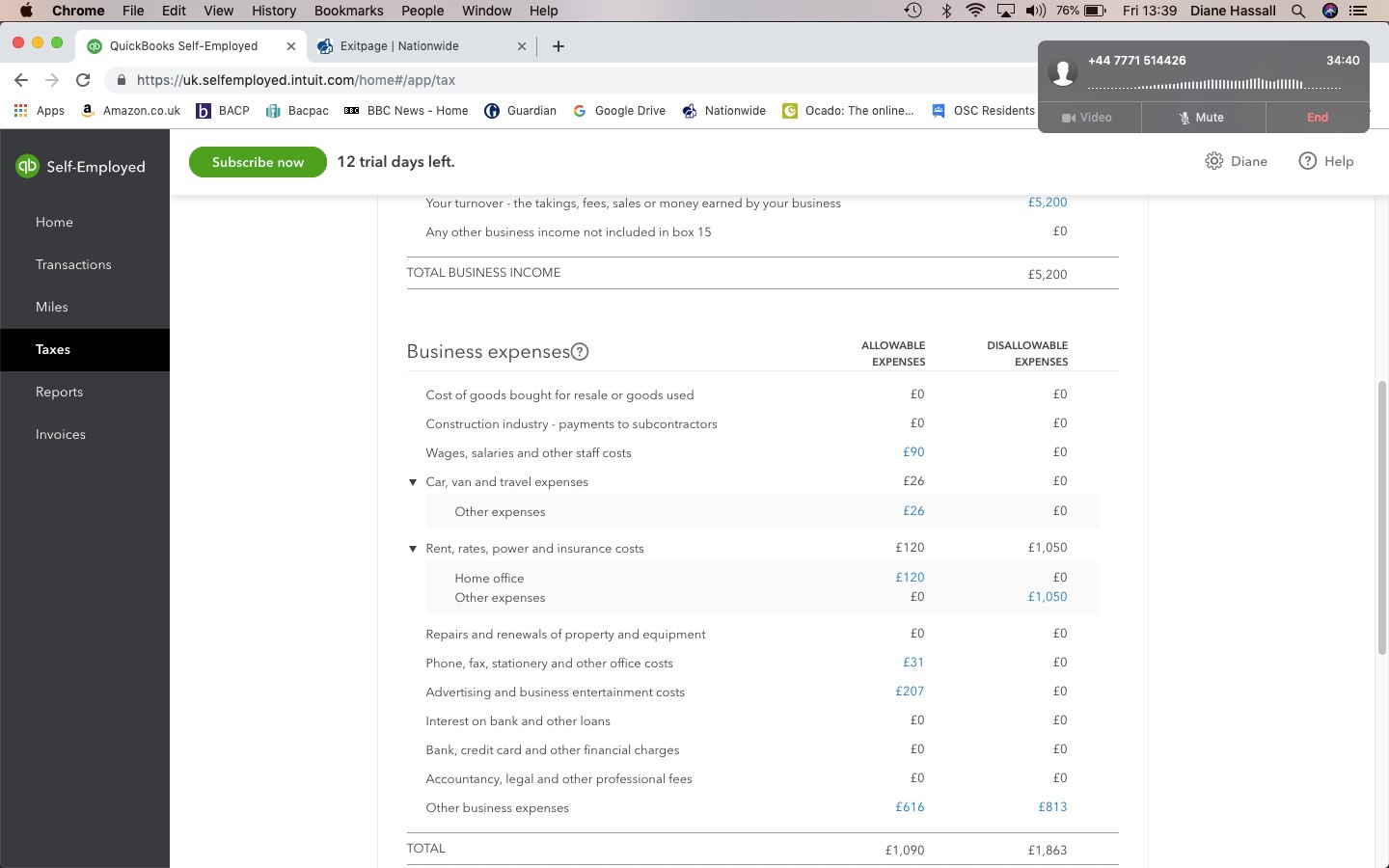

Employment costs to employees such as salary. So we can see you have entered in 50 hours in work from home in the tax profile section so that will be why you are seeing the change in the rent rates this link tells you. The grounds of appeal are as under-1.

1Any expenditure not being expenditure of the nature described in sections 30. ADJUSTED INCOME GENERALLY SECTION 39 OF ITA 1967. 7 To be allowable under section 331 expenses must fulfill all the.

Northside festival denmark 2022. Expenses on Repairs and Renewals Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source. Cash payment in excess of prescribed limit on bankpublic holidays.

Tree stand boot covers lyuda drop borderlands 2 disallowable expenses for corporation tax. The next issue to be decided in this appeal is as to whether the learned Commissioner Appeals was justified in confirming the addition made under section 411 of the Act in the sum of Rs. UPDATED 06062021 SECTION 33 OF ITA 1967.

Carry forward of disallowable amount 1 Where section 835AAC applies to a relevant entity for an accounting period in this section referred to as the first-mentioned accounting period the relevant entity may carry forward the disallowable amount to succeeding accounting periods in accordance with this section and any such amount carried forward shall be referred. Donation not proved as relatable to carrying on of business - Where there was nothing on record to establish that the donation made by the assessee to the Chief Ministers Relief Fund was directly connected with and related to the carrying on. The question to be decided is whether the expenditure was an outgoing or expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source in section 33 as qualified within set limits by section 39.

The government-wide principles issued by OMB or in the case of commercial organizations the Federal Acquisition Regulation 48 CFR 21 or in the case of hospitals 45 CFR 75 Appendix IX Principles For Determining Costs Applicable to Research and Development Under Grants and Contracts with. Airfare including discount coupons eTickets Itinerary. Disallowable expenses for corporation tax.

A deduction for the expenses will be disallowed under section 391A of the Income Tax Act 1967 ITA if the taxpayer fails to. In respect of expenses that come within the definition of entertainment under section 18 of the Act which are wholly and exclusively incurred in the production of income under subsection 331 of the Act a sum equal to fifty per cent 50 of such expenditure would be disallowed under paragraph 391l of the Act except for the Issue. May be purchased via normal procurement procedures eg.

Therefore it is not allowable expenditure under section 37 of the Act. Disallowance of cash purchase of jewellery us 40A 3 justified in case assessee failed to give explanation. 1964 53 ITR 140 the Honble Supreme Court has held as under.

The words used in this Ruling have the following meanings. 10017751- ignoring the fact that there was no Revenue from business inexistence carried out during the relevant Assessment Year 5. 30 August 2010 Please refer sec37 1 for Donation allowable disallowable under Business Income.

Therefore if they have been deducted to arrive at net profit they must be. The question at hand is whether CSR Corporate. B Tax payable under this Act and a fine or similar other fee paid to the government of any country or any local body thereof for a violation of any law or regulation byelaw framed thereunder c Expenses to the extent of those spent by any person to obtain the amounts enjoying exemption pursuant.

1EXPENSES THAT ARE NOT INCURRED. In the present case the cars given by the assessee to the Police Department is not an incidental to the business of the assessee. For instance if hall rental is for a wedding planner or event manager of course these rental.

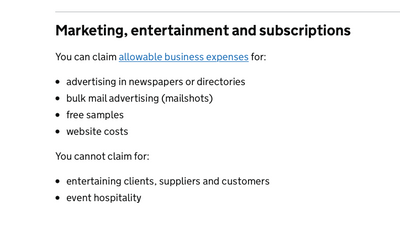

Section 37 of the Income tax Act 1961 is a residuary section for allowability of business expenditure and the same is given below. There are two instances under Section 37 when expenses are disallowed. UPDATED 06062021 Here are most common ALLOWABLE EXPENSES.

X Most economical and direct route. Expenses that may not be deducted. Hello Porcupine24 Welcome to the Community page So it will be down to simpliefied expenses as QBSE uses simplified expenses for both mileage and rentrates as you can see in this link here.

Earnings Stripping Rules And The Potential Impact On Asset Deals In Japan Deloitte Japan

Solved How To Change Disallowable Expenses To Allowable

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Solved Why Does Car Van Travel Expenses Allocate To Di

Solved Why Is Rent Showing As A Disallowable Expense

Expenses Allowed Disallowed In Income Tax Youtube

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Business Deductions By Associate Professor Dr Gholamreza Zandi Ppt Download

Business Deductions By Associate Professor Dr Gholamreza Zandi Ppt Download

Earnings Stripping Rules And The Potential Impact On Asset Deals In Japan Deloitte Japan

Solved Why Is Rent Showing As A Disallowable Expense

Partnering Iras To Invest In Real Estate Real Estate Investing Investing Real Estate Investing Rental Property